Payroll processing is a time-consuming process. Although the time taken to finish payroll processing depends on the size of the organization. The number of employees impacts the time taken to complete payroll processing tasks. Some companies take up to 5-6 days.

But before we get into understanding the importance of Payroll Outsourcing, let’s understand payroll processing in its entirety.

What is Payroll Processing?

Payroll Processing is one of the most crucial functions of an organization as it’s the part where you compensate your employees. To do this your team needs to calculate the total wages based on attendance, make proper justifiable deductions, send payment stubs, and deliver the pay-out.

Now it’s not as easy as it sounds. In the US, the Internal Revenue Service (IRS) and the Department of Labor (DOL) have given certain provisions and established regulations that have to be maintained.

Why is Payroll Processing Time-Consuming?

There are specific tasks in payroll processing that might take more time than others. Such as:

- Calculating Payroll Taxes and Deductions

- Updating Employee Records

- Issuing paychecks.

However, if your company has an automated system in place, that might reduce the time required for payroll processing.

What is Payroll Outsourcing?

Payroll Outsourcing simply means that an offshore firm will handle all your payroll processing. This is possible today because the payroll process has become standardized and can be easily executed and later monitored through payroll processing software.

Calculating wages, importing timesheets, withholding deductions, scheduling pay-outs, and all other payroll tasks are executed through the software. Thus, making it very easy to delegate to an offshore accounting partner.

Payroll Outsourcing is one of the most outsourced accounting services all across. Here are a few stats:

- 12% of organizations worldwide outsourced their payroll processing completely.

- 45% of small businesses outsource payroll.

Why Should You Consider Outsourcing Payroll Processing Services?

Business owners and Accountants have expressed multiple reasons for outsourcing payroll processing to offshore accounting firms. Here are a few of them:

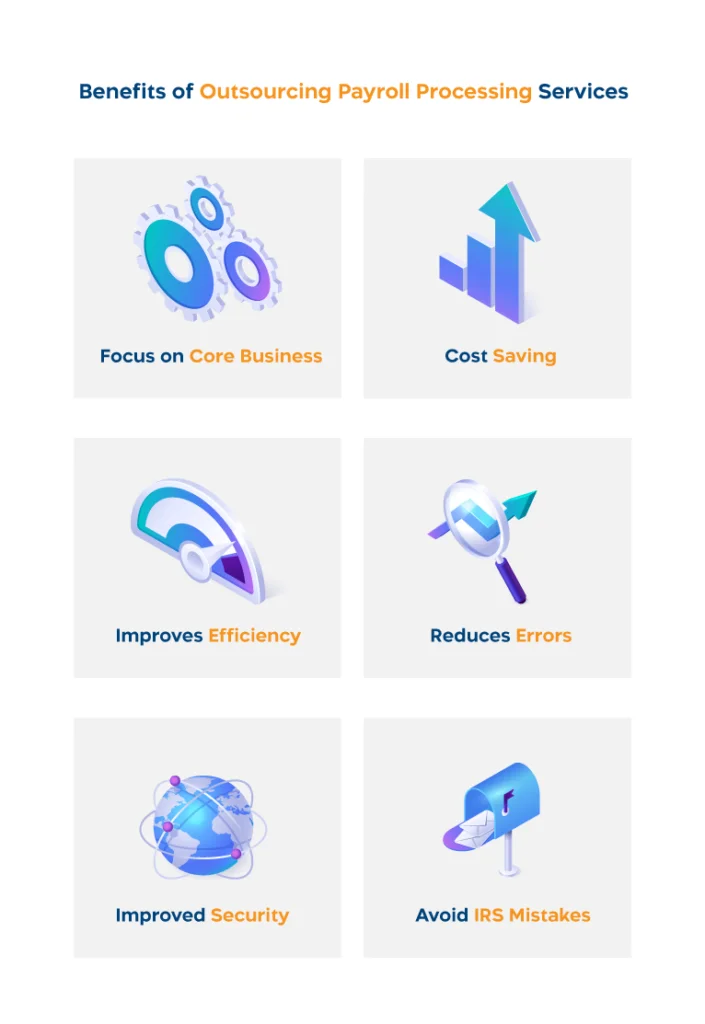

Focus on Core Business

By outsourcing payroll processing you save a lot of time. You are able to continue with crucial tasks that bring in revenue while being assured of your payroll process is taken care of. You are able to draw your attention to business development, customer relationship management, and marketing.

Cost Saving

Maintaining an in-house payroll management team can be more expensive than outsourcing to an offshore firm. That’s because outsourcing eliminates the need to hire and train payroll staff.

Improves Efficiency

Through outsourcing, you can leverage accessing an experienced payroll processing provider. Who will be more efficient at processing than an in-house team given the years of experience in payroll processing? Professional payroll outsourcing companies have experienced professionals who are aware of payroll complexities and taxes regulated by the IRS.

Reduces Errors

The offshore team has the sole responsibility of executing the tasks with ultimate accuracy as opposed to multiple tasks and responsibilities that an in-house team has to fulfill. Payroll processing can be complex. Sometimes there are complicated payroll calculations that can lead to errors which result in inaccurate payments or tax penalties. The offshore team has handled complicated payroll calculations and knows how to tackle them.

Must read Common Payroll Compliance Mistakes That Payroll Services Company Should Not Commit

Improved Security

Payroll is a very complicated and sensitive procedure so it needs to be managed properly. But, sometimes with the in-house payroll staff, a few security problems arise like the risk of identity theft, embezzlement of funds, or tampering with company files. There’s also the risk of tampering with the in-house payroll software by viruses, malware, or hackers. This consumes a lot of energy and time for business owners to detect security loopholes in their payroll system.

But, with the use of outsourcing payroll services, business owners don’t have to worry about anything. First, employees of payroll outsourcing companies have no direct link with the company’s staff so they won’t have any personal motive to manipulate the payroll books. Secondly, they use high-tech security tools and have a full-fledged IT team that can easily identify any cyber threats. So, with the use of outsourcing services, you will be easily able to enhance the payroll security system of your company.

Avoid IRS Mistakes

In IRS states, 40 percent of small businesses pay an average penalty of $845 per year for late or incorrect filings and payments. A small error or omission in creating the payroll account can turn out very costly for the small business. As they can’t fight against the government authorities and waste their resources on a worthless fight in the courtroom. One small mistake in submitting taxes on time can put a lock on your company.

In this case, payroll outsourcing services can be very useful for small business organizations. Outsource companies have a full team that constantly keeps a tab on the latest federal, local, and industrial tax laws and makes sure that the payroll of the company is created based on all the latest rules and regulations. This way companies can minimize their risk level and don’t have to pay money for outrageous penalties.

Sit Back and Relax

Business owners can get a piece of mind after hiring an outsourced payroll company to manage the payroll system of their company. They just need to provide basic payroll information to the outsourcing company and they will automatically design the payroll of the month by following all the local taxation laws. This way business owners don’t need to stress over creating the payroll and they can focus on other important business issues.

Must read Questions to Ask a Payroll Specialist before Outsourcing Payroll Services

Steps To Remember When Outsourcing Payroll Processing?

Here are a few things you need to consider before you outsource your payroll processing. This step-by-step guide will help make sure that you have outsourced your payroll efficiently to the right company.

Step 1 – Choose a Company

The first step to outsourcing payroll processing is to select the right company. The company must be experienced in undertaking complex payroll calculations and applying proper tax deductions. You can ask them about the industries they have handled the payroll processing. You need to make sure that they are aware of tax laws and regulations in relation to employment.

Step 2 – Share the Documents

Once you have selected the right offshore partner. You need to work on providing all relevant company information to the outsourcing company. This information will consist of all your company policies, employee policies, company regulation, shift timings, breaks or time-offs, incentives, insurance plans, etc. Here is a list of documents that you will need to provide.

- Company Policy

- Employee Policy

- Company Regulation

- Shift Timings and Time-Offs

- State-Specific Tax Regulations

- W-4 Forms

- W-9 Forms

- Bank Credentials

Step 3 – Give payment access or give approvals

The payroll outsourcing company will also be responsible for dispersing the employee salaries from time to time. So, you need to provide payment disbursement access or give paycheck approvals. This step is crucial as payment disbursement takes up a lot of time in payroll processing.

Step 4 – Proper Time Sheets

It is very important to track employee timesheets. It’s best to make sure that the employee timesheets are well recorded and then submit them to the payroll outsourcing company. If you maintain timesheets via software, payroll outsourcing companies have provision for that too.

Must read Step by Step Process for Outsourcing Tax Preparation Services from CapActix

Why Choose CapActix For Outsource Payroll Processing?

Accounting professionals at CapActix have handled 100+ payroll processing clients from different industries. Due to the best-in-class infrastructure built, our accountants are able to maintain and execute payroll processing tasks efficiently.

Payroll outsourcing services have proved to be highly beneficial for large and small firms. As they are able to free themselves from the mundane payroll processing tasks that take up most of their time.

If you want to outsource your payroll processing, get in touch with us. We can discuss the points that concern you and the questions that you have.

Mail – biz@capactix.com , Call – +201-778-0509

Or you can schedule a meeting based on the best time that works for you. – Schedule a meeting now