Entrepreneurs are usually busy and do not have much time to manage all of the accounting obligations of running a firm. Accounting services may be outsourced. However, some business owners are confused about which services to outsource. Businesses tend to outsource their accounting services to save time and money by receiving high-quality accounting services and proactive financial advice.

A company’s specific goals and expectations typically influence the process of selecting outsourced accounting services. An Accounting Outsourcing Company, on the other hand, may perform numerous accounting duties at the same time.

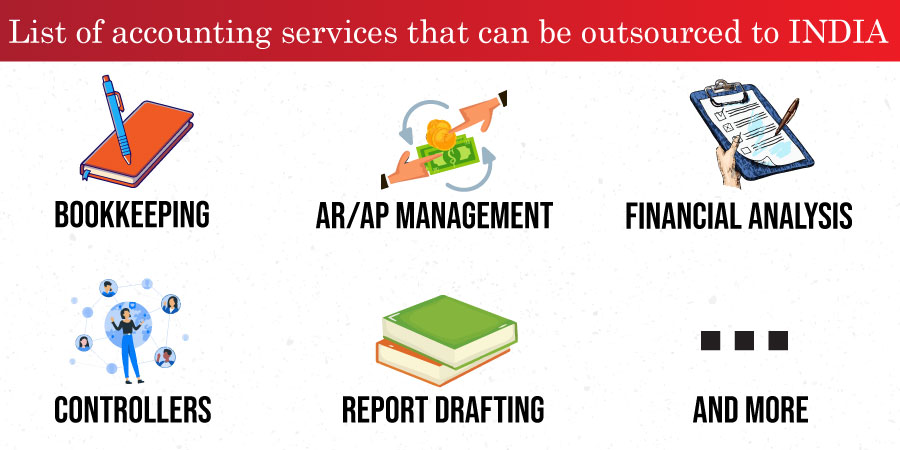

Take a look at these forms of outsourced accounting services:

- Bookkeeping Services: Bookkeeping is a time-consuming and sluggish process that may consume a significant amount of time from your staff. Outsourced Bookkeeping Services responsibilities have been considerably easier since the introduction of cloud bookkeeping software. Outsourcing this particular service can give you detailed reports to see more financial facts and make better decisions. By outsourcing the bookkeeping services, you can get rid of tasks like time and expense management, accounting/bookkeeping software setup, order cash management, etc.

- Management of Accounts Receivable/Payable: Handling Accounts Receivable (AR) and Accounts Payable (AP) are two typical outsourced responsibilities. You might want to think about outsourcing your AR services to ensure that you are paid on time. If you hire Accounting Outsourcing Services, you will be dodging tasks like invoice approval, expense reporting, check processing, etc.

- Financial Analysis and Planning: Outsourcing your financial planning and analysis may offer you a comprehensive understanding of your company’s financial situation, allowing you to make better business decisions. Outsourcing this service can also provide you with access to resources 24 hours a day, seven days a week. You can get all necessary financial data anytime you need it while efficiently handling functions like process mining, board and bank reporting, company financial data analysis, planning, budgeting, forecasting, etc.

- Services for Controllers: With strategic supervision and management, Outsourcing Controller Services may help you expand your organization. It can also give you financial reporting and insights that are accurate and timely. Outsourced controller services often perform responsibilities that include audit reporting, management reporting, employee and vendor communication, etc.

- Financial Statements and Report Drafting: Accounting businesses’ core skill is preparing financial papers and reports for external and internal usage. A team of Certified Public Accountants (CPAs) consolidates your spending and revenues through financial statements. Consequently, they can help you maintain control over your financial flow. CPAs keep their accounting books in order by capturing and updating all relevant information while maintaining the accuracy and security of your financial information. If you wish to share your financial performance with board members, stakeholders, or the general public, they can also prepare financial reports for you.

- Processing of Payroll: You can gain the knowledge of payroll specialists by Outsourcing Payroll Services. Once you’ve entered the relevant data, payroll software may automate your payroll operations. You can limit the risk of any obligations arising from payroll or income tax return errors, resulting in significant fines, by outsourcing. Outsourcing allows you to have control of the most recent software and technology. Therefore, it allows you to increase the efficiency and consistency of your payroll processes. Additionally, your outsourced business can use robotic process automation (RPA) to improve process efficiency.

- Reporting and Filing of Taxes: Finding an Outsourced Tax Services that can help you stay compliant with local, state, and federal tax rules is the key to effective tax preparation. Your outsourced accounting company can assist you in reducing your exposure to different accounting and financial computation mistakes that might negatively impact your business operations. CPAs can help you file your returns and disclose your taxes correctly before the deadlines. Outsourced tax preparation services include several functions that help with company tax administration, including franchise tax support, reviewing statements for compliance, payroll tax collection, filing, payment, etc.

- Accounting for Costs: Cost accounting is a component of accounting services that identify the real costs of producing or providing a service. To assist you in making price decisions, cost accountants collaborate closely with production, supply chain, marketing, and R&D departments.

- Forensic Accounting or Fraud: Forensic accountants can help a corporation that has been the victim of fraud, or its accounting contact has gone without leaving any accurate records behind. Outsourcing this service can aid in the reconstruction of a ruined business’s records, the restoration of missing papers, and much more. Your outsourced team may also examine your internal operations to boost efficiency, increase security, and safeguard assets against future fraud attempts.

All your accounting duties will be handled by a team of specialists who will safeguard your information and keep it safe and confidential. They can use impenetrable security mechanisms to prevent the existing data security dangers. As a result, outsourcing can help you reduce the danger of a data breach, a hacked security system, or internal fraud.

The bottom line

All in all, Outsourcing accounting services can take the load off your plate and help you work in a more organized as well as efficient manner. Many CPA Firms do Accounting Outsourcing Services for various clients.

If you are looking for a good accounting outsourcing company, CapActix is your place. CapActix is a certified firm that provides unique accounting and finance solutions to various industries. CapActix takes businesses to the next level by streamlining their operations. It involves integrating one’s business with the most up-to-date technology and innovations to improve bookkeeping and investing our resources to create a strong foundation for any corporation. It also offers competent tax preparation services to businesses in the United States.

To get more insights, you can visit www.capactix.com or send mail on biz@capactix.com.