The goal of any business is to make maximum profits, and they should take all possible steps to ensure that. Filing tax returns is an arduous process, both for the firm and the clients. The fierce competition among the US firms, and the average cost of preparing a tax return there, has led many of them to outsource tax preparation services from India. The skilled professionals and cheaper technology help do the same tasks effectively and at a lesser cost.

The working of the CPA

CPA firms work in challenging economic conditions and find cost-effective and cheaper solutions to make more profits in the US. There is a considerable shortage of qualified professionals for filing tax returns in the tax season, and this is when outsourced tax preparation services come in handy for these firms. CPA firms can save some serious money and earn more profits considering the other cost-effective solutions with outsourcing tax preparation from India. At last, the goal of running any business is to make profits and make more of it.

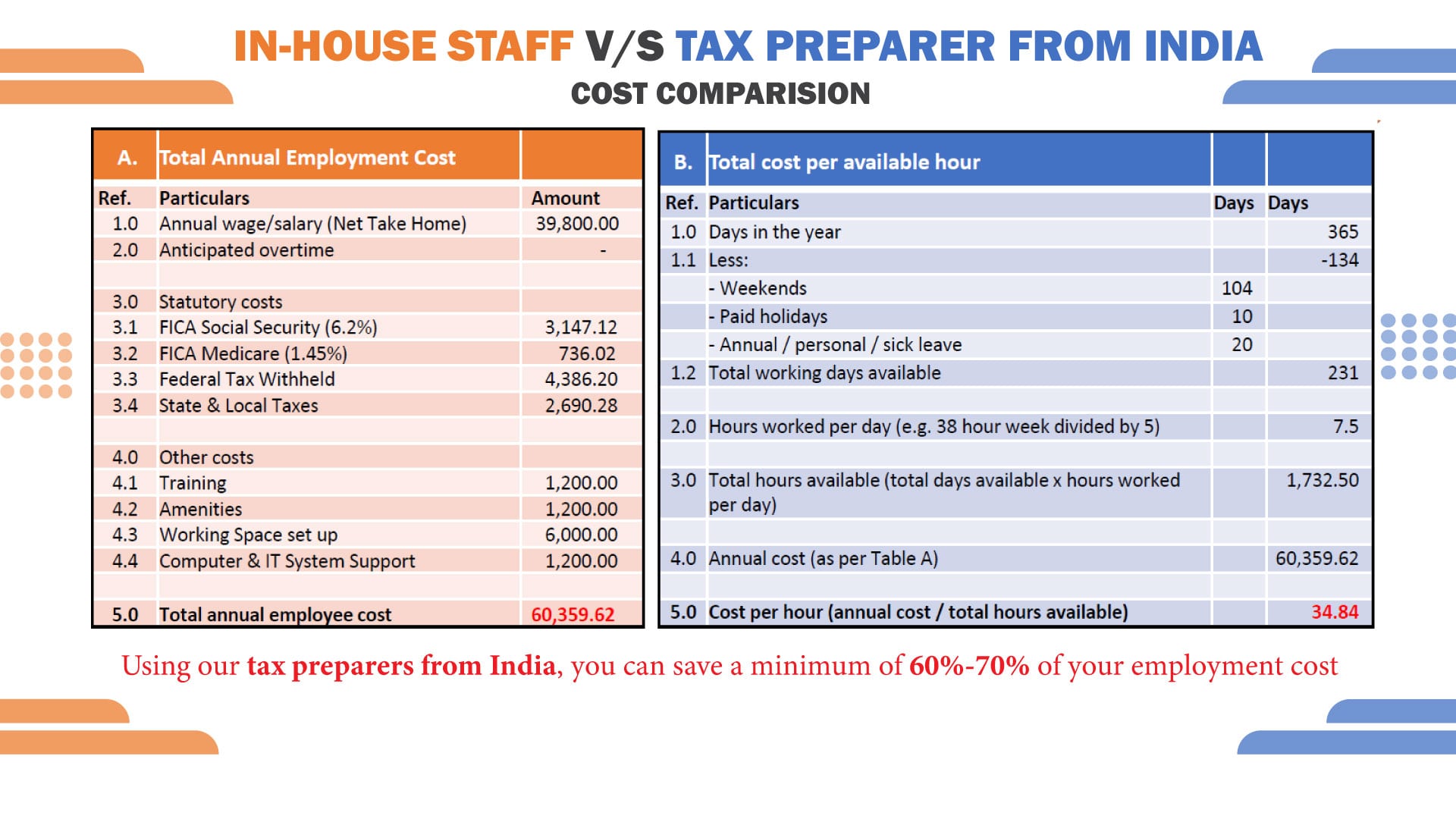

Accounting is a task that requires expertise and precision. From a small enterprise to a medium /large scale firm, maintenance and keeping track of the finances can be arduous as it requires diligence and a lot of effort. CPA firms can save up to 70% of the costs by tax preparation outsourcing from India.

The Indian version of a CPA (Certified Public Accountant) is the CA(Chartered Accountant). Compared to CPAs, the CA’s are almost as qualified, but there is a considerable difference in their charge for preparing a tax return. A CPA would charge around USD 176 with no itemized deductions for submitting a form 1040, while the average fee for an itemized form 1040 is USD 273. Compared to CA’s, the average cost of filing a tax return is somewhere between USD 25 to USD 50 in India. This makes the CPA firms interested in hiring CA’s for tax preparation.

Now let’s find out how much money a CPA firm saves by hiring tax preparers from India. Read to know more.

- Experienced and Skilled Accountants: India has many professionals working as accountants, with years of experience and skilled ones. The best part is that due to the difference in currency value between the two countries, even if a US-based CPA firm pays these Indian accountants more than their average rate for filing returns, it will still be peanuts for these firms. Moreover, hiring a permanent employee for these CPA firms will cost around USD 50,000 – USD 70,000 for a year, with additional facilities and benefits excluded. These professionals have to work mainly in the tax season. So, by hiring Indian tax preparers, they need to pay them for their work by considering the amount of work they have done and the number of days, hours they have put in.

- Better Facilities and Infrastructure: We all know that India is a competitive market, and tax firms there want to be better than their competitors at all costs. That’s why they focus on having the best infrastructure for their employees. Be it the technology, educating their employees consistently, or using innovative ideas. All these facilities are available for the CPA firms but at a much higher cost than the tax preparer from India. Thus, outsourcing tax return preparation services are cheaper and sometimes even better.

- All Day Work: In the tax season, CPA firms have to work the whole day to accommodate all their clients’ tasks. The cost of hiring professionals for round the clock work, considering the night shifts, etc., is very high compared to Indian professionals. These CPA firms can hire Indian tax professionals for all-day work and at a relatively low cost of operation. An average CA is paid approximately 10 dollars per hour in India, and this can go up to 40 dollars per hour in rare cases, depending upon the experience and skill. On the contrary, an average CPA takes about $30 per hour, going up to $ 500. This makes the task cheaper, and convenient for these firms, especially during the tax seasons.

- Unemployment Factor: India is a populated country, and hence the rate of unemployment is relatively high there. Many qualified professionals who are skilled in their work do not have any jobs. This makes them ready to work for even a less than average pay scale. CPA firms can leverage this and save even more money.

- Better Work at Cheap Price: In India, the telephone, internet, and other technical facilities are way cheaper than in the US. This brings down the cost of operation even lower in India. Moreover, the tax professionals in India are quite good at their work, hence there is less or no chance of discrepancies.

By picking the right tax preparation outsourcing firm with good testimonials and a clean track record, the CPA firms can get their work done better and relatively cheaper. For example, the average cost of one gigabyte of data is $0.26 in India, while an average US citizen pays close to 12 dollars. Thus, these firms are able to get the same work done, both in a better way, and at a cheaper price.

Here we have made a brief comparison on how hiring the tax preparer from India can save you up-to 60-70% of your cost.

The Bottom Line :

As it is pretty clear from the points mentioned above, CPA firms can save a lot of money by hiring tax professionals from India. The main reasons are:

- The low cost of living.

- The difference in the currency’s value.

- The average wage rate.

- Cheaper technology.

- Skilled and experienced professionals

Here is 6 Common Misconceptions About Outsourced Tax Preparation Services from India

To get more insights, you can visit www.capactix.com or send mail on biz@capactix.com. The team works hard to ensure that you get quality content and the best available information about complex topics like these. This article was written to provide information as to how the CPA firms can save some serious money by hiring tax professionals from India. Hope it serves the purpose.