The working capital that businesses possess is one of the most crucial aspects to ensuring that the operations are running smoothly. However, tracking and determining the amount of working capital one holds at a given time can be challenging. Many companies may not be able to find unnoticed cash or assets hidden in their balance sheets that can be utilized.

One major reason for this confusion is the existence of Accounts Receivable. It refers to the money payable to an enterprise by a customer for the goods and services provided by the enterprise. In short, it is the credit that is given by the enterprise to the customer for a short period.

Why should an enterprise opt for accounts receivable?

Most financial experts determine the benefits of accounts receivable through the “turnover rate”. This rate is defined as the measure of the number of times the enterprise has successfully collected the accounts receivable from customers. However, the offer of Accounts Receivable Outsourcing can also bring forward the following advantages:

- It helps to build the relationship of trust between the company and the customer.

- It can increase the liquidity of a company by preventing the wastage of existing capital.

- Increases the number of sales taking place.

Issues regarding account receivable management:

The process of Accounts Receivable Management can differ on the basis of the industry, the enterprise resides. However, most companies face a set of similar problems:

- Errors in recording the funds that are required to be paid.

- Lack of proper collection methods of payment at regular intervals.

- Lack of interaction between the credit team and the sales team.

- CRM platforms and billing systems are not operational.

- Resolutions of small-balance transactions are not carried out.

- No structure in the collection and storage of data.

Therefore, the above reasons could contribute to an enterprise’s problems in its working capital management process.

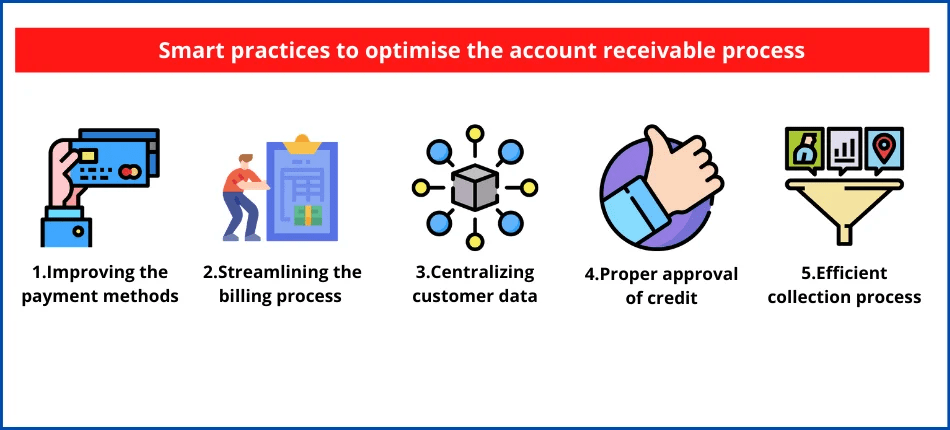

Smart practices to optimize the account receivable process:

Account receivable can make the process of calculating working capital difficult. However, this should not deter one from offering their customers credit. To make this process easier, one can carry out the following practices:

1. Improving the payment methods

It is common for customers to make payments for goods and services through alternative means. One need not stick to the traditional cash methods. In recent times, payments are taking place virtually through third-party payment apps or other CRM platforms, ERPs, and more. Therefore, an enterprise should ensure that the payment pathway is functional and taking payments. This contributes to the convenience that the customer will receive while they pay back their dues.

2. Streamlining the billing process

Another method to ensure accurate and timely collection of payments from customers is to streamline the billing process. This will systematically record the customer activity in separate customer accounts, deadlines for payment, price of the goods and services provided, and more information. This process requires proper management as one should avoid confusion, which may lead to a delay in the payment.

The best solution to this problem is to bring in automation.

Automating one’s billing process will allow an enterprise to accurately generate invoices and requires less time to do so. In addition to this, there is no need for human intervention, which will reduce the chances of human error. The customer can also directly download the invoice from the enterprise resource planning software.

3. Centralizing customer data

As mentioned before, the databases that hold information regarding the customer require a proper structure. This is because when information is being stored in multiple systems, it can be easy to misplace data. Therefore, making it hard to track the accounts receivable. Therefore, a business should turn to a centralized system that can house data collected from all existing customers at a given time. One should ensure that this data is regularly updated to prevent any confusion that may occur later.

Therefore, information regarding credit limits, payment terms, discounts, and other information will also be recorded and stored in a single region. The purpose of collecting customer data is also to analyze the customer base. That is, the enterprise receives a kind of track record regarding the activities of the customer as well as current debts owed.

4. Proper approval of credit

It is also crucial to properly outline the terms and conditions that accompany the credit a customer is eligible to receive. An ideal method of approving credit should be clear as well as time-effective. All aspects regarding the payment and deadlines must also be intimated to the customer at a convenient time by the credit department. After doing so, the credit team must reach out to the sales team about the credit owed and the customer details.

Although this may seem like a straightforward concept that most enterprises should be able to implement easily, in reality, many companies tend to struggle with this. These businesses look to make more sales while forgetting to outline proper payment terms.

5. Efficient collection process

The key to benefiting from accounts receivables is to ensure that the collection of dues is carried out without any hiccups and within the agreed-upon deadlines. Maintaining a reasonable day’s sales outstanding and a healthy ART ratio shows how effective the collection policies are functioning.

The answer to this problem is also to implement automation. Automation can vastly decrease the number of potential human errors that could take place. In addition to this, one could also use software to update statuses regarding the payment or extension of deadlines. In this way, one can reduce the time required to keep track of the account receivables.

Here you can read about 7 Steps to Improve Accounts Receivable Management by Accounts Receivable Outsourcing.

What is Account Receivable Outsourcing?

Given that tracking and accounting for credit and payment can cause a strain on the other operations of a business, one can opt to outsource this portion. That is, a third party will come to reduce the burden of recording account receivables. One such option that is available at the moment is CapActix.

CapActix is a certified business solutions enterprise that provides opportunities to other businesses to outsource various operations. The enterprise offers its services in the management of working capital. One of the more exclusive services they provide is the optimization of working capital management through account receivable outsourcing. They also offer services like operational analysis, Bookkeeping outsourcing services, Inventory management services, and more. In essence, CapActix works towards assisting a business, especially small businesses, in financial management by implementing certain practices that will streamline various processes.

All in all, it is a proven fact that introducing account receivables in one’s business is one of the best ways to optimize it. It brings several advantages to the table. More importantly, it can greatly influence the enterprise-customer relationship positively.