Managing accounting tasks without the right expertise can lead to mistakes, inefficiencies, and lost time. As businesses grow, the need for accurate financial management becomes critical. Many companies find that managing QuickBooks in-house is too time-consuming and prone to errors.

This is where hiring QuickBooks bookkeeper becomes an effective solution. A dedicated professional can handle your books, ensuring accuracy and freeing up time for more strategic work. This article will explore whether it’s a worthwhile investment by examining the cost-benefit of hiring a QuickBooks bookkeeper.

Understanding the Cost Benefit Analysis

Conducting a detailed cost-benefit analysis is essential before you hire QuickBooks bookkeeper. It helps you weigh the potential advantages against the costs, ensuring that your business gets the most value from the investment.

Benefits of Hiring a QuickBooks Bookkeeper

- Expertise and Accuracy

One of the primary benefits of hiring a QuickBooks bookkeeper is the expertise they bring. A QuickBooks expert for hire has specialized knowledge in managing complex financial tasks and ensures that all entries are accurate. This level of accuracy minimizes errors, reducing the risk of penalties due to incorrect tax filings.

- Time Savings

Hiring a QuickBooks bookkeeper saves your internal team valuable time. Instead of focusing on time-consuming bookkeeping tasks, your team can work on business development and client management. The time savings alone can justify the decision to hire QuickBooks bookkeeper.

- Financial Insights

Hiring Expert QuickBooks Bookkeeper provides more than just bookkeeping. With their experience, they can offer valuable insights into your company’s financial health. By generating real-time reports, they help you make data-driven decisions that can guide budgeting, investments, and future planning.

- Scalability

As your business expands, financial management becomes more complex. Hiring a QuickBooks bookkeeper ensures that your accounting system can scale efficiently. Whether your needs increase seasonally or permanently, a QuickBooks bookkeeper adapts to the demands of your business, allowing for seamless growth.

Costs Involved in Hiring a QuickBooks Bookkeeper

Before deciding to hire QuickBooks bookkeeper, it’s essential to understand the different costs involved. These costs will vary depending on whether you choose to hire in-house or outsource to a QuickBooks expert. Both options come with their unique considerations, and this section breaks down these costs into salary, training, and software-related expenses.

Salary and Compensation Structure

When you hire QuickBooks bookkeeper as an in-house employee, you must account for fixed costs such as salary, benefits, and additional expenses like workspace. These costs can be significant, especially if your business requires full-time support. Moreover, providing long-term job security and benefits, such as healthcare and retirement contributions, adds to your total expenditure. For smaller businesses or those with limited budgets, this can become a considerable financial burden.

On the other hand, outsourcing to an offshore QuickBooks bookkeeper offers much more flexibility. Offshore services often come at a lower cost while providing the same level of expertise. You only pay for the services you require, making this option ideal for businesses looking to manage their finances without committing to high fixed costs. This pay-per-service model allows businesses to allocate their resources more effectively, avoiding the overhead of a full-time employee.

Training and Onboarding Expenses

Hiring an in-house bookkeeper often involves additional costs related to training and onboarding. Even experienced bookkeepers need time to adjust to your specific business processes and systems, which can slow down productivity in the initial stages. You may also need to invest in training programs to keep your in-house team up-to-date with the latest QuickBooks updates or financial regulations. These expenses can accumulate over time, making the onboarding process more costly than anticipated.

By contrast, hiring a QuickBooks expert from Outsourcing Company eliminates most of these training and onboarding expenses. Professionals from outsourcing agencies typically arrive with extensive experience and training. They are already proficient in using QuickBooks, which means they can hit the ground running. As a result, you avoid the downtime typically associated with training, saving both time and money in the process.

Software and Tool Costs

Another crucial factor to consider when you hire QuickBooks bookkeeper is the cost of other software and tools. In-house bookkeepers often require access to the latest Project Managment Software or License and Tools for day-to-day work which can be expensive. Licensing fees, regular updates, and maintenance costs add to the overall expense. Additionally, your business might need to invest in supplementary tools to ensure smooth operations.

However, hiring QuickBooks bookkeepers from Offshore Company already have access to the necessary software. When you opt for an outsourced solution, the cost of providing software is typically covered by the agency, saving your business from those additional expenses. This not only cuts costs but also ensures that your bookkeeping is always done using the most up-to-date tools available, further enhancing accuracy and efficiency.

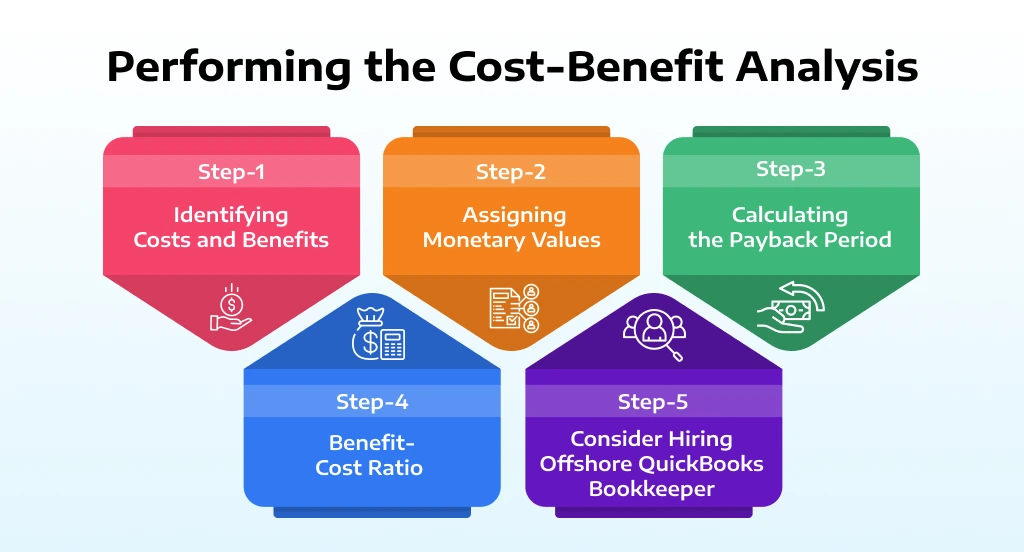

Performing the Cost-Benefit Analysis

- Identifying Costs and Benefits

Before deciding to hire QuickBooks bookkeeper, it’s essential to identify all potential costs and benefits. Include everything from wages and training to savings on time and error reduction.

- Assigning Monetary Values

Next, assign a monetary value to each cost and benefit. For instance, calculate the financial impact of eliminating bookkeeping errors or estimate the revenue gained by freeing up your team to focus on higher-value tasks. These calculations will help you decide whether hiring a QuickBooks bookkeeper provides a solid return on investment or not.

- Calculating the Payback Period

The payback period is the time it takes to recoup the costs of hiring a QuickBooks bookkeeper. A short payback period indicates that the investment will start to generate returns quickly, making it a financially sound decision.

- Benefit-Cost Ratio

Finally, calculate the benefit-cost ratio to see if the benefits outweigh the costs. A ratio higher than 1 suggests that hiring a QuickBooks expert is a profitable investment for your business. - Consider Hiring Offshore QuickBooks Bookkeeper

For businesses seeking cost-effective bookkeeping solutions, hiring an offshore QuickBooks bookkeeper offers significant advantages. Offshore professionals typically provide the same level of expertise as local hires but at a fraction of the cost. This allows businesses to maintain a high standard of service without the financial burden of hiring locally. Offshore QuickBooks bookkeepers are skilled in handling a wide range of bookkeeping tasks, from managing daily transactions to preparing detailed financial reports. They are well-versed in QuickBooks software and can help your business streamline its accounting processes.

In addition to the cost savings, offshore bookkeepers offer flexibility that is hard to match with in-house hires. Businesses can scale their bookkeeping services up or down based on their current needs. This is particularly beneficial for companies experiencing seasonal fluctuations in their workload or those with temporary spikes in accounting tasks. By choosing an offshore option to hire QuickBooks bookkeeper, companies can access top-tier bookkeeping services while controlling their expenses.

What are the Different Pricing Models of Offshore Bookkeeping?

Offshore bookkeeping services offer a variety of pricing models, providing businesses with the flexibility to select an option that best fits their financial and operational requirements. Whether a company needs ongoing, part-time, or project-based support, there’s a model to suit every budget and workload.

- Full-Time Bookkeepers

A full-time QuickBooks bookkeeper for hire is ideal for businesses with consistent, daily bookkeeping needs. Companies that require regular financial reporting, invoice processing, and payroll management will benefit from having a dedicated bookkeeper available full-time. This model provides continuous support and ensures that your financial records are always up to date. While full-time offshore bookkeepers offer significant cost savings compared to local hires, they provide the same level of commitment and expertise, making them an attractive option for larger businesses or those with more complex financial requirements.

- Part-Time Bookkeepers

For businesses that don’t require full-time bookkeeping but still need regular assistance, hiring a part-time QuickBooks bookkeeper is a great option. This model allows companies to pay for services only as needed, making it ideal for small to mid-sized businesses with less frequent bookkeeping demands. Part-time bookkeepers can handle tasks such as monthly financial reports, tax preparation, and periodic payroll processing. This option helps businesses save on costs without compromising the quality of their financial management.

- Hourly Bookkeepers

Smaller businesses or those with seasonal or temporary needs often benefit from hiring a QuickBooks bookkeeper for hire on an hourly basis. This model is highly flexible and allows companies to pay for specific tasks, such as reconciliations, tax filings, or financial cleanup projects. Hourly services are particularly useful during tax season or when a business needs extra support for short-term projects. This option provides the most cost-effective solution for companies that don’t require ongoing bookkeeping services but need expertise for specific periods or tasks.

- Key Factors That Affect Costs

Several factors affect the cost when you want to hire QuickBooks bookkeeper, including the complexity of the tasks, the expertise required, and the pricing model chosen. Offshore bookkeepers can help reduce these costs significantly while still providing high-quality services.

How Much Does a QuickBooks Bookkeeper Charge Per Hour?

- Average Hourly Rates

The hourly rate for a QuickBooks bookkeeper for hire varies depending on location and expertise. In the U.S., rates typically range between $25 to $75 per hour. However, offshore services can provide more affordable rates, often between $10 to $20 per hour.

- Rates by Region

Rates vary based on the region to hire QuickBooks bookkeeper. Hiring a QuickBooks expert for hire from countries like India or the Philippines can lead to significant cost savings compared to local hires in the U.S. or Europe.

- Impact of Experience on Rates

Experience plays a large role in determining the hourly rate for a QuickBooks bookkeeper for hire. While more experienced bookkeepers may charge higher fees, their proficiency can lead to faster turnaround times and fewer errors, making the investment worthwhile.

FAQs

Yes, you can use QuickBooks as a bookkeeper to manage financial transactions, generate reports, and track expenses for businesses.

Yes, hiring QuickBooks Bookkeeper from CapActix allows you to cancel the contract by giving appropriate notice as per the contract.

Conclusion

To hire QuickBooks bookkeeper from CapActix offers a range of benefits, from improving accuracy to freeing up time for your core team to focus on more important tasks. Conducting a cost-benefit analysis allows businesses to clearly understand whether hiring a QuickBooks expert is a valuable investment. Offshore options provide flexibility and affordability, making it easier for companies to manage their finances efficiently.

Whether you need consistent support or temporary bookkeeping assistance, hiring a QuickBooks bookkeeper can help streamline your business’s financial management. As you evaluate the costs and benefits, you’ll find that hiring a QuickBooks expert for hire is an investment that can pay off in both the short and long term.

CapActix offers reliable options to hire QuickBooks bookkeeper. This offering give access to experienced professionals who ensure accuracy and efficiency. To explore details on QuickBooks bookkeeper for hire, please contact us.