Every taxpayer pays a certain amount of money from their income to contribute to the development of the country in the form of ‘tax’. The Internal Revenue Service department is then responsible for verifying the documents and processing them to let the taxpayers acclaim the refunds.

The CPA firms and individual taxpayers outsource the preparation of Income Tax returns to focus on the core activities and increase their productivity.

Every taxpayer is obliged to pay tax on time. They cannot find loopholes to evade their tax because the department of revenue has a set of determiners to check for compliance and then process the tax refunds. Therefore, you need to keep in mind a checklist to consider before filing Income Tax Returns to speed up the process of refund.

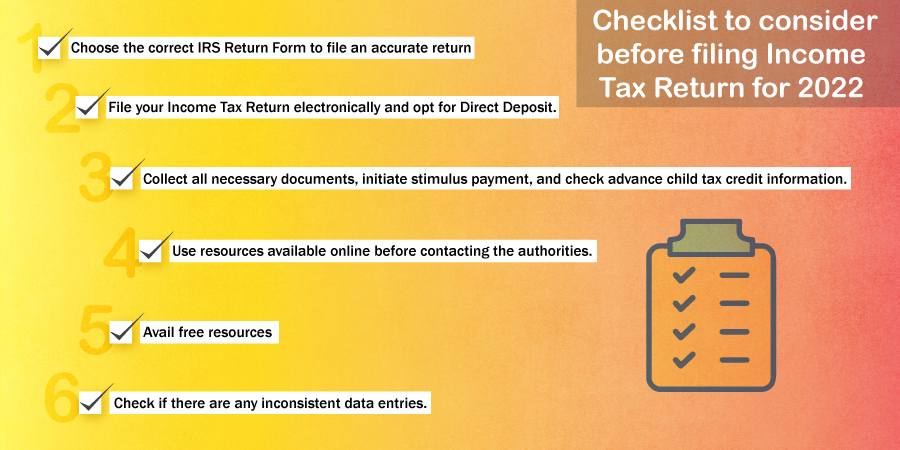

Here is a checklist you can consider before you file your IRS Tax Return:

1. Choose the correct IRS Return form to file an accurate return.

An Income Tax Return form is selected based on the income earned and the residential status of the taxpayer. For instance, one criterion is to file Income Tax Returns only for people under the age of 65 or older and single with an income of $12,400 – $14,050, other incomes, and one property (house). Another criterion is to file the taxes separately if married with an income of a minimum of $5. Therefore, different criteria demand the process of filing the returns. You can get professional help to get the right form. Tax preparation agencies have a team of professionals who help you choose the correct Income Tax Return form to avoid delay in the process of claiming the tax refund.

2. File your Income Tax Return electronically and opt for direct deposit.

When you file your Income Tax returns electronically, you get rid of many paperwork requirements. The software helps do the calculations and prevents silly mistakes. Outsourced tax preparation agencies can help you get all the necessary details through their professionals in the team. CapActix is one such platform that helps you with every section of filing an Income Tax Return through integrity, loyalty, and intensity. Opt for a direct deposit while filing your Income Tax Return to prevent any delays in the Tax refund. You can add details from multiple accounts. However, the department of revenue initiates the refund to a verified account to maintain safety and security.

3. Collect all necessary documents, initiate stimulus payment, and check advance child tax credit information.

As per the IRS guidelines, it is necessary to have an ‘Advance Child Tax Credit and Economic Impact Payment Information’ while filing returns. These are a must-have before filing an Income Tax Return. While filing your Income Tax Returns electronically, you will need AGI (Adjusted Gross Income) from your previous returns. If you do not have the AGI data from last year’s returns, you can enter $0 as the previous year’s Adjusted Gross Income. However, the taxpayers who have entered Economic Impact Payment or Advance Child Tax Credit should enter $1 as Adjusted Gross Income. Avoid errors of missing out on these documents by outsourcing tax preparation. CapActix helps with outsourced tax preparation services. They analyze the documents using 3Cs (Correctness, Completeness, and Consistency), send estimates, and review your returns before submitting them.

4. Use resources available online before contacting the authorities.

Try to resolve your queries via online resources and official websites because the authority’s assistance remains under high record and takes time for your turn. Avoid the delay by following some simple tips:

- Use the official website for tax questions, tax payments, and refund status. The official website will have no appointment slot, waiting period, or delays.

- Subscribe to email-letters and follow the IRS department’s social media account handles to get a hold of the latest alerts and tax news.

- Download the official app to get in touch with the department of revenue quickly.

- Follow all social media platforms i.e. Facebook, Instagram, Twitter, and LinkedIn, and get scam alerts, initiatives, and services.

- Taxpayers have the option to get the information in their preferred languages using online resources.

- File an LEP to request the language change.

Dealing with all of these requirements of filing an Income Tax Return can be exhaustive. Therefore, Outsourcing tax preparation to India will solve almost all your concerns.

5. Avail free resources

2020 has been a challenging year for every taxpayer. Keeping this in mind, the department of revenue has time and again reminded taxpayers to use the free resources to help themselves. Resources that are of use and are available quickly are:

- The IRS website itself provides significant information regarding the filing of Income Tax returns.

- Use a free file to stop the delay with the Income Tax Return. Free File provides online products and services by top tax software providers for free.

6. Check if there are any inconsistent data entries.

There is a possibility that some inconsistency in the data input could trouble you with tax refund claims. Recheck all the data you have entered into the software as per the IRS guidelines. If you miss some information, your return can go to scrutiny assessment. Scrutiny assessment will take another year to get processed and require plenty of documents to prove and validate the data. Therefore, recheck everything you have entered by an authorized professional who is familiar with your tax history.

Our service for CPA firms is a solution that every taxpayer is seeking. We receive all the documents and financial statements via secure sharing portals. Our expert team of CA, EA and CPAs double-check all data before entering it into the software. Therefore, the outsourced tax preparation services can increase turnaround by 50%. Firms can focus on the growth of the core services and their profitability. You can get further details on our website or email us on biz@capactix.com