Taxation is an inevitable part of any business. Certainly, the government of every country makes every detail of taxation available. However, it is not as easy and businesses grapple with accurate tax filling.

The major factors that increase complexities include the constantly changing tax laws, financial obligations, and tight deadlines. Undoubtedly, it is essential to ensure that taxes are filed correctly and on time for smooth business operations. However, there are instances when businesses might need additional time to prepare their tax returns. This increases the requirements and demands of IRS business tax extension from a professional company. The business tax extension becomes a vital tool for businesses seeking more time to meet their filing obligations.

An IRS business tax extension provides a strategic option to extend the deadline for filing a business’s tax return. While it’s not an extension to pay taxes owed, it grants businesses the flexibility to organize their financial records. Undoubtedly, this ensures accurate tax calculations and avoid costly penalties. This extension offers invaluable support for companies managing complex financials or experiencing delays in gathering necessary documents.

Understanding how to properly file for an IRS business tax extension can help ensure compliance and effective tax planning, ultimately benefiting the financial health of any business. This comprehensive guide is going to cover these details to help you understand IRS business tax and accurate way of taking its complete advantage.

What is an IRS Business Tax Extension?

It is an official request to extend the deadline for filing a tax return of a business. This extension provides businesses with extra time to prepare and file their taxes. It is important to understand that this extension only applies to the filing of taxes, not the payment of any taxes owed. Still, businesses need to pay their taxes by the original filing deadline. Alternatively, they could incur penalties and interest.

Businesses may need an extension for various reasons, such as:

- Lack of proper documentation

- Complexity of financial records or

- Unavailability of key personnel.

An extension gives businesses additional time to organize their finances and ensure that everything is filed correctly.

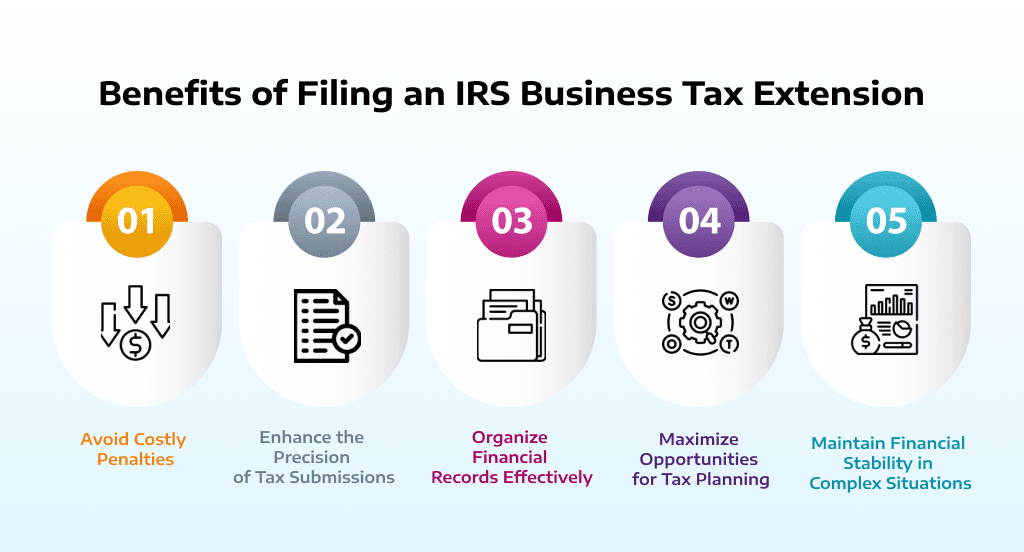

Major Benefits of Filing an IRS Business Tax Extension

Certainly, if you are thinking to file business tax extension to fill in IRS, there are several advantages. Let’s take a look at the top 5 advantages of it.

- Avoid Costly Penalties

Failing to file taxes on time often results in penalties that can strain a business’s finances. Filing an IRS business tax eliminates the risk of late filing penalties. Moreover, it gives businesses the extra time needed to prepare their returns accurately.

This safeguard protects against unnecessary fines. Furthermore, it provides businesses with peace of mind. However, it is crucial to remember that while the filing deadline is extended, taxes owed must still be paid by the original due date to avoid accruing interest. - Enhance the Precision of Tax Submissions

Accuracy is key to avoiding audits and ensuring compliance with IRS regulations. The time gained through a business tax extension allows for meticulous preparation. Moreover, it enables businesses to reduce errors such as miscalculations or incomplete data.

With this added time, businesses can verify their financial information, reconcile discrepancies, and identify all eligible deductions. This ensures that the final submission is accurate and reflective of the business’s financial activities, reducing stress and enhancing credibility. - Organize Financial Records Effectively

Gathering and organizing financial records is often the most time-consuming aspect of tax preparation. A IRS business tax extension provides the opportunity to compile these records comprehensively. Certainly, a business can ensure that no details are overlooked.

This process includes collecting receipts, reviewing transactions, and identifying deductible expenses. Undoubtedly, proper documentation aids in accurate tax filing. Moreover, it strengthens the business’s readiness for potential audits or IRS inquiries. - Maximize Opportunities for Tax Planning

Strategic tax planning can significantly impact a business’s financial health. The additional time provided by a business tax extension allows for careful evaluation of tax-saving opportunities, optimizing deductions, and aligning tax strategies with long term goals.

This thoughtful approach ensures that businesses make the most of the available options. As a result, it ultimately minimizes their tax liability. It creates room for discussions with tax professionals to craft effective strategies tailored to the unique needs of businesses. - Maintain Financial Stability in Complex Situations

Businesses often face unpredictable financial changes, whether it is fluctuations in revenue or unforeseen expenses. Filing an IRS business tax extension provides the flexibility to steer through these complexities. This ensures that financial decisions are well-informed and accurate.

This additional time allows businesses to address any discrepancies, manage cash flow effectively, and avoid hasty decisions that could have long term consequences. As a result, the tax preparation process becomes more manageable and efficient.

The advantage of extension for IRS business tax filling is to achieve a more structured, accurate, and strategic approach to meeting their tax obligations. This extension simplifies the filing process. Moreover, it supports broader financial objectives.

Understanding Form 7004: The Key to IRS Business Tax Extension

Form 7004 is the document used to apply for an IRS business tax extension in the USA. A business needs to submit this form to the IRS to officially request the extension.

To file for an extension, businesses must meet certain eligibility requirements. One of the major requirements is that a business has to be a U.S.-based business or having a business tax return due to the IRS. Once eligible, businesses must complete Form 7004 accurately to avoid delays or complications in the process of filling IRS business tax.

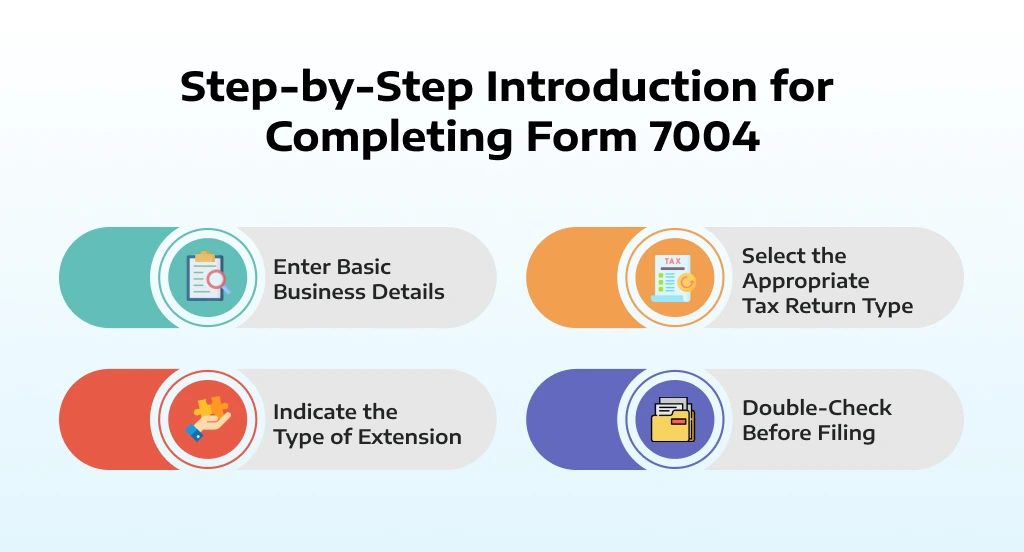

Step-by-Step Introduction for Completing Form 7004

Filing Form 7004 correctly is critical for obtaining an IRS business tax extension. Follow these steps to ensure accuracy and avoid delays.

1. Enter Basic Business Details

Provide your business name, employer identification number (EIN), and the tax year. You must ensure these match IRS records to prevent issues.

2. Select the Appropriate Tax Return Type

Choose the tax return type that applies to your business, such as C-Corps, S-Corps, or partnerships. This ensures the IRS business tax processes your extension correctly.

3. Indicate the Type of Extension

Specify the business tax extension type and include reasons, if applicable. While detailed explanations aren’t usually required, clarity ensures smooth processing.

4. Double-Check Before Filing

Review the form thoroughly for errors, such as incorrect EINs or mismatched return types. Ensure estimated taxes owed are accurate and paid by the original deadline, as the extension applies to filing only and not payments.

Filing Method: Electronic vs Paper Filing

Businesses have the option to file Form 7004 electronically or via paper. Electronic filing is faster and more efficient, which provides immediate confirmation from the IRS that the business tax extension request has been received. Paper filing, on the other hand, may take longer to process, and the business must wait for a mailed confirmation.

Deadline and Timeline for Business Tax Extensions

The deadline for filing an IRS business tax extension depends on the type of business entity. The standard deadline for most businesses is typically March 15 for corporations and April 15 for sole proprietors or LLCs. However, each business entity may have its specific filing date.

Businesses must be aware of the different IRS deadlines to ensure that their tax extension is submitted on time. Failure to meet the deadline for filing the extension could result in penalties and interest charges.

Common Mistakes to Avoid When Filing IRS Business Tax Extension

- Error in Completing Form 7004

One of the most common mistakes when filing for a business tax extension is errors in completing Form 7004. Incorrect information or missing details can delay the extension process and potentially cause complications.

- Misunderstanding the Difference Between Filing and Payment Extension

A business may incorrectly assume that an extension for filing taxes also extends the time to pay taxes. However, the IRS business tax applies to filing and to payments owed. Businesses must still pay any taxes due by the original deadline to avoid penalties.

- Failure to Accurately Estimate Taxes Owed

Another mistake businesses make is failing to estimate taxes owed accurately when applying for an extension. Underestimating taxes owed can lead to interest charges and penalties for the underpayment, even if the extension is approved.

What Happens After Filing a Business Tax Extension?

Once a business files for an IRS business tax extension, the IRS will confirm receipt of the application. Depending on the entity type, the business may be granted an extended deadline to file its tax return. Businesses must manage their taxes carefully during this extended period, keeping track of their financial records to ensure accurate filings.

During this time, businesses should continue to gather relevant tax documents, review their financial records, and strategize tax planning. It is necessary to stay organized. This helps businesses to ensure that they meet the new deadline without issues.

Penalties and Consequences of Missing the Extension Deadline

- Avoiding Penalties for Missed Deadlines

Even with an approved IRS business tax extension, businesses must submit their tax returns by the extended deadline. Missing this new deadline results in costly penalties, which can strain financial resources and tarnish compliance records.

- Managing Interest on Unpaid Taxes

Failing to pay estimated taxes by the original business tax extension filing date leads to accruing interest on the unpaid amount. This added cost continues to increase throughout the extension period, significantly raising overall tax liability. Paying taxes on time minimizes these unnecessary expenses.

- Steps to Minimize Late Filing Consequences

Missing the extension deadline requires prompt action. Filing as soon as possible reduces penalties. Partnering with tax professionals ensures businesses explore available options to address accrued interest and penalties effectively.

FAQs

No, it cannot be extended further. The business tax extension provides businesses with a set amount of additional time to file their tax returns.

Yes definitely, extension of IRS business tax only extends the filing deadline. Still, taxes owed must be paid by the original filing date to avoid penalties and interest.

If you file electronically, you will receive immediate confirmation from the IRS. Paper filings may take longer to process.

Conclusion

When dealing with multiple financial obligations and detailed requirements, meeting tax filing deadlines can be a rigorous process. Opting for a business tax extension is an effective way to gain more time and ensure a well-organized filing process. This additional time reduces stress and supports accurate tax preparation. This makes it a valuable tool for businesses.

Filing for an IRS business tax extension offers businesses the extra time they need to prepare accurate tax returns and avoid penalties. Understanding the process, completing Form 7004, and adhering to the deadlines can streamline their tax filing and ensure compliance. However, businesses must still ensure that they pay their taxes on time to avoid interest charges.

If you need help managing your IRS business tax extension, filling Form 7004 or handling your tax preparation needs, reach out to one of the top and most professional offshore accounting companies, CapActix. The expert team of CapActix can assist your business with IRS business tax and other tax-related matters. To learn more about how IRS business tax extension services of CapActix can simplify your business tax filings, please get in touch now.