Overview

Tax preparation outsourcing service is a professional service that provides businesses with help in preparing their taxes. You can avail of such services through an outside contractor which can also include assistance with filing tax returns, managing tax liabilities, and other related tasks.

The vital goal of tax preparation outsourcing services is to help you to minimize your tax burden and maximize your profits. With the help of Tax preparation outsourcing services, you can access highly skilled professionals with up-to-date knowledge of the taxation laws that help to ensure that you always stay compliant with all the relevant tax requirements.

You can reduce overhead costs associated with the in-house management of accounting processes. You don’t need to hire and train additional staff to manage increasingly complex tax laws.

Outsourcing Tax Services can be very profitable for a variety of reasons as it can help to reduce the burden of filing taxes on your own, it can help to save time, money, and stress since it removes the need to keep up with ever-changing tax codes and regulations. Additionally, it can help to improve accuracy and ensure that the filing is completed correctly and in a timely manner.

What is a tax preparation outsourcing service?

- You can define Tax preparation outsourcing service as the practice of hiring an external, third-party company to provide services related to preparing and filing taxes.

- Tax Preparation Outsourcing Services include providing tax-preparation software, setting up a system for tracking income and expenses, preparing tax forms and schedules, assessing deductions and credits, filing taxes on behalf of clients, reviewing prior returns, and advocating on behalf of the client in tax matters.

- This type of service is often much more cost-effective than hiring in-house experts to manage taxes.

How does tax preparation outsourcing service work?

- Tax outsourcing is the process of hiring a third-party accounting firm to manage the company’s tax compliance processes. The hired accounting firm will handle all the necessary calculations, forms, and filing deadlines associated with taxes which can include everything from preparing and filing income tax forms to filing quarterly returns and paying estimated taxes.

- The client will then be responsible for providing the necessary information, such as income and expenses, to the tax specialist or firm for review and filing. The tax specialist or firm will then prepare the return and submit it to the appropriate taxing authority. The client will pay the appropriate fees associated with the preparation and filing of the return, as well as any taxes that are due.

How tax preparation outsourcing service is beneficial?

The perks of Tax preparation outsourcing services include:

- Reduced Costs: Save money on labor expenses and administrative costs which are associated with tax preparation.

- Enhanced Efficiency: Increase your efficiency in the tax preparation process.

- Access to Experts and Experienced Professionals: Get access to experienced professionals who are familiar with tax laws and regulations which will help you to ensure that all the necessary documents are always accurate, and the best possible tax treatment is provided.

- Improved Accuracy: By outsourcing the task of preparing taxes, you can benefit from enhanced accuracy in the tax preparation process.

- Improved Time Management: Enhance the time management process by tax preparation outsourcing services and free up the time and resources that can be used for other tasks. This can help to improve productivity and efficiency.

What are some common challenges that arise while outsourcing tax preparation services?

- Communication Issues: This is one of the most common issues experienced when tax preparation outsourcing services. The lack of communication between the client and the service provider can lead to misunderstandings and errors.

- Data Security: Ensuring the security of a client’s confidential information is paramount when tax preparation outsourcing services.

- Regulatory Compliance: Tax laws and regulations are constantly changing, and it is important for any service provider to be up-to-date on these changes.

- Price: Price is often one of the most important considerations when selecting a service provider.

- Quality of Service: Clients should also assess the quality of service they are receiving.

How to overcome the common challenges that arise while outsourcing tax preparation services?

- Establish a clear line of communication, and expectations and respond promptly to any inquiries or issues that arise.

- Adhere to a set of security protocols, such as two-factor authentication, encryption, and data backup, to protect the client’s data.

- Have a thorough knowledge of the relevant laws and regulations, with all applicable rules and regulations.

- To ensure a fair price, clients should research different providers and compare prices and offerings. Clients should also consider the quality of the services, not just the cost.

- Review the provider’s past performance and customer feedback, and ask questions to ensure they are receiving the best possible service.

Must read 8 Tax Preparation Related Challenges Faced by CPA Firms

What is the cost of a tax preparation outsourcing service?

- Usually, while outsourcing tax preparation the cost depends on a number of factors which includes the amount of work involved, the complexity of the tax return, the type of services needed, and the service provider’s hourly rate.

- Generally speaking, the cost of tax preparation outsourcing services can range anywhere from $100 to $1000, depending on the specifics of the job.

How does outsourcing tax preparation impact my timeline for filing taxes?

- You can speed up the process of filing taxes by Tax preparation outsourcing services. Depending on the level of services that you choose and the amount of time you give to your tax preparer, you could have your taxes filed in as little as 48 hours.

- If you have complex returns or multiple investments and accounts to manage, it may take longer. If you are filing taxes in multiple states, the timeline will likely be longer due to the additional paperwork involved.

How do CPA firms select a provider of tax outsourcing services?

CPA firms usually select Tax Outsourcing Services based on the services offered, quality of work, and pricing. Additionally, they may consider technological capabilities, ability to scale, and customer reviews. Many firms also ensure that the provider has the right personnel to handle the firm’s Tax Outsourcing needs.

- Identify Tax Outsourcing Needs: Potential CPA firms should assess their current workload, staff experience and skill sets, and the type of tax returns they typically handle.

- Research Potential Providers: Potential providers should be thoroughly evaluated, including reviewing qualifications, experience, pricing, customer reviews and more.

- Request Proposals: The proposals should outline the scope of work, timeline, pricing, and any other important information required.

- Compare Proposals: Factors such as the provider’s expertise, timeline, pricing, and customer reviews should be considered for comparison before choosing a provider.

- Make the Selection: CPA firms should make their selection and enter into an agreement with the provider they have chosen.

What services do tax outsourcing companies provide?

- Tax outsourcing companies provide a wide range of services, including tax preparation, filing, compliance, payroll processing, bookkeeping and accounting, strategic tax planning, financial statement preparation, and audit support.

- Additionally, many tax outsourcing firms also offer specialized services, such as international tax compliance, state and local tax compliance, fixed asset management, and real estate tax services.

How can I communicate with my outsourced tax preparer if I have questions or concerns?

- If you have questions or concerns about your outsourced tax preparer, the best way to communicate with them is either through email or phone. You should also consider scheduling a face-to-face meeting if you need to discuss more complicated tax matters.

- You can communicate with your outsourced tax preparer via email, phone, or an online chat platform. Make sure that you keep records of all communication with them to ensure that you are able to refer back to them if needed.

What information do I need to provide to my outsourced tax preparer?

The basic information that you need to provide before tax preparation outsourcing services include the following:

- Your full name and contact information.

- Your Social Security number.

- Wage, earnings, and expenses documents, such as W-2, 1099, and 1098.

- Business and investment income documents, such as 1099, and K-1 forms.

- Documentation of deductible expenses, such as receipts, canceled checks, and statements.

- Documentation of other income sources, such as gambling winnings, alimony, and prizes.

- Tax documents from the previous year, such as 1040 and 1099s.

- 8. A record of any estimated tax payments you have made for the current year.

- Bank and other financial account numbers.

- Your previous year’s adjusted gross income.

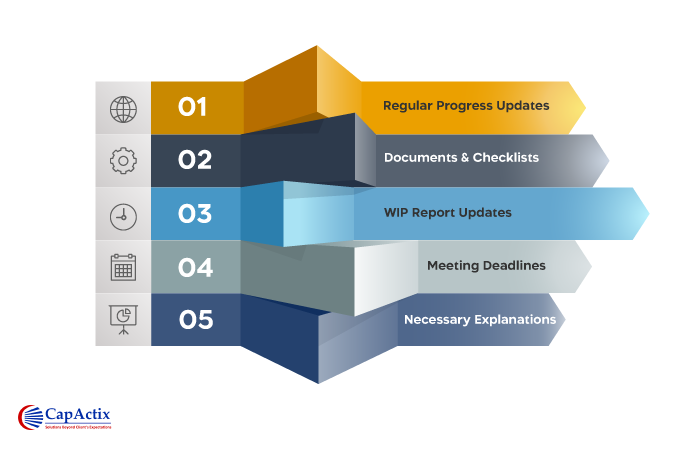

How to track the progress of my tax preparation when partnering with An Outsourced Tax Preparation Service Provider?

- Request regular progress updates from the firm:

You can make sure to ask for a timeline as updates on when certain tasks for when the tax preparation will be complete, as well as updates on when certain tasks have been completed. - Ask for copies of the documents and checklists:

Ask the firm for the documents of tax preparation. This will give you a better understanding of what’s involved in the process and will help you track progress. - Request a regular work-in-progress report:

Requesting a regular Work-In-Progress list should indicate the tasks that have been completed, along with the expected completion date of any remaining tasks. - Ensure the firm is meeting your expectations and deadlines:

If you feel like the firm is not working at a pace that is satisfactory to you, contact them and express your concerns. - Explanation from the firm regarding certain necessary processes:

If there are any major changes to the tax return preparation process, ask the firm to explain the change and why it was necessary.

Finally, remember that the best way to track progress is to stay in close contact with the firm and maintain an open line of communication. This will ensure that you are kept up to date on the progress of your tax preparation.

Can I rely on a tax preparation outsourcing service firm to keep my information confidential and secure?

- Most tax preparation outsourcing service firms are compliant with data protection laws and regulations, and their staff is trained to handle confidential data responsibly so you can rely on them.

- The data is protected with encryption technology and stored in secure servers. The tax preparation outsourcing service firm is also responsible for conducting regular security assessments and audits to ensure that the data is kept safe and secure.

Must read Step by Step Process for Outsourcing Tax Preparation Services from CapActix

How Much CPA Firms Can Save by Hiring Tax Preparers from India?

- Generally, firms can save up to 40-50% on labor costs by hiring a tax preparer from India, this is because Indian tax preparers typically offer their services at a lower rate than those in the US. The cost will vary depending on the size of the firm and the number of returns they process each year.

- Additionally, firms can also be benefitted from having access to a larger pool of experienced and highly qualified tax preparers from India, who can provide quality services at competitive prices.

Must read How Outsourced Tax Preparation Services save over 70% of CPA Firm’s Cost?

How to review my tax return when using an outsourced tax preparer?

1. Ask for a copy of the return:

Make sure to thoroughly review the accuracy of all forms, line items and calculations before signing the return and ask your tax preparer for a copy of your tax return, including all relevant schedules.

2. Compare the return to your records:

Check to see that income and expenses are properly reported, and that credits and deductions are properly applied. Compare the return to your records to make sure all information is accurate and complete.

3. Verify the calculations:

Carefully review and verify the calculations and ensure that the numbers are correct and that the credits and deductions are accurate.

4. Research the unfamiliar items:

If you have questions about any items on the return, research them. If you have any questions about the return, make sure to contact the tax preparer with your inquiries. – Ask for an explanation if you don’t understand something on the return.

5. Request a review meeting:

If needed request a meeting with your tax preparer to review the return before you authorize the filing. This will give you the opportunity to ask questions and double-check any items that may need clarification.

Conclusion

- Tax Preparation Outsourcing services is a great way to save time and money, while also ensuring that your taxes stay in order. While there are many risks involved in outsourcing your taxes, these services can be beneficial to many businesses.

- In conclusion, before making a decision, you should consider the cost, the services provided, and the reputation of the company you are outsourcing to. Tax preparation outsourcing services is an effective way to free up more time and resources during the tax season. Understanding the details and facts of tax preparation services can help you make the best decision for your business.

Why Choose CapActix For Tax Preparation Outsourcing Services?

CapActix boasts a team of experienced tax professionals with expertise in various industries and a proven track record of delivering quality work. We use the latest tax software and technology tools to streamline the tax preparation process and ensure accuracy, and they have robust security measures in place to protect sensitive financial data and maintain confidentiality.

We are also flexible and scalable, allowing them to customize their services to meet the unique needs of each client and scale their services as the client’s business grows. They offer excellent communication and customer support, ensuring that clients are informed about the status of their tax preparation and can get their questions answered in a timely manner.

If you have not made up your mind yet, don’t worry. You can opt-in for a Free 15 Hour Trial

If you want to experience a smooth Tax Season 23, we recommend you hop on a call, and get all your questions answered by our business head. Schedule a meeting now