CPA and Accounting Firms have started turning down tax preparation work due to labor shortages. There is a severe lack of accounting and tax professionals in the market. The reason is that they do not intend to compromise on the quality of their work as they want to hold on to their really good clients. To be able to identify possible deductions and benefits or any other red flags, the tax preparer and the reviewer have to be able to give enough time.

An Accounting firm in Northwest Birmingham has turned down dozens of clients in the past years. According to their estimate, the lost business has cost them more than $430,000 in revenues.

Accountants are not having it

The total number of US Accountants and Auditors leaving their jobs is 300,000. Which is a 17% decline. The reason is long hours of the same monotonous work and comparatively low pay. And to fill the gaps, college students are filling in at a diminishing rate. So, the existent gap is evident and is significantly affecting the ability of CPAs, Accounting Firms, and EAs.

Which firm does not desire to expand its clientele if there is an increasing demand out there? But the consequences and the possible errors that work overload brings is the reason for resistance.

Must read How to cope with the high volume of tax returns effectively in 2023?

A Practical Solution

Due to this, a lot of firms have started turning to outsourcing tax preparation firms in India. But how does this benefit them? Accounting services in the US cost up to $37.14 – $175 per hour. Whereas the cost for outsourced tax preparation in India is $15 per hour.

By Outsourcing Tax Preparation Services, they can share their burden, allowing them to segregate their clients. They can focus more on marketing activities that bring in more clients, thereby maximizing their revenue and reducing an overload of burden, stress, and anxiety.

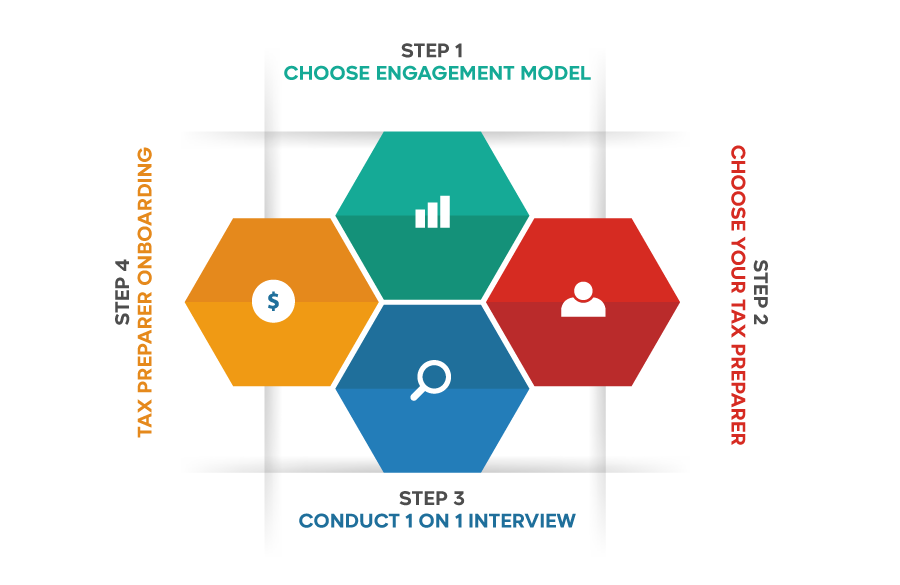

Process of Outsourcing from CapActix

Outsourcing Tax Preparation Services from CapActix is tailored to fast-track the signing up process and get to the execution asap. We do that because we understand the importance of being sensitive to your time. Tax Seasons do not go easy on anyone. The amount of work coming in demands immediate attention.

Below mentioned are the Steps to Outsourcing Tax Preparation Services from CapActix

Step 1: Choose your engagement model

At this stage, you need to choose which model you want to go for. We offer two models for outsourcing tax preparation services.

- Per return model

- Hire Tax Preparer

1. Per Return Model: If you are looking for seasonal help and not sure about fix number of hours, you can go for this model where you can outsource the number of returns as and when you need help and get them completed.

Let’s say you have 50 tax returns to be filed, for that you might not need to go for a hiring model considering the volume of the tax returns. But if you choose outsourcing tax preparation services on a per-return basis, you will be charged based on the number of returns that are outsourced.

Under this model, we charge fix base price for the first few hours and if return preparation takes time over and above those hours, we charge per hour rate for extra hours.

2. Hire Tax Preparer: Under this model, you can hire your own remote tax preparer who can work just like your in-house staff. Our hire models are tailored with different specifications and adjustments which suit your tax preparation needs.

At CapActix we have 3 models.

Full-Time

The full-time tax preparer will work 08 hrs a day for you. They will work exclusively for you. Here are certain benefits you are liable to receive if you hire an offshore tax preparer.

- You get to interview the remote staff before you hire them.

- The remote staff will prepare and submit timesheets daily.

- You can constantly monitor the remote staff, which prevents errors.

- You have Full-Control. As you choose the tasks you want the remote staff to do.

Part-Time

The part-time tax preparer will work 04 hrs a day for you. You can opt for a part-time tax preparer if you are confident of the in-house resources you have and you only need reduced tax preparation support. However, you are still liable for the above-mentioned benefits with the difference in hours of course.

Hourly

The hourly model is specially curated for those firms who are not sure of the amount of work they are going to execute. So, they pay on an hourly basis, which means they only pay for the number of hours the remote tax preparer has worked for them, nothing more – nothing less.

Step 2: Choose the Tax Preparer that you want

The best thing about hiring tax preparers is that you get to handpick the tax preparer you want by screening multiple CVs. You might have particular criteria for the tax preparer that you want to hire. So, in this step, we will send you the CVs of the available tax preparers.

Here are a few benefits of choosing your tax preparers.

- You can hire remote staff who has more experience in core tax expertise.

- You can choose a remote staff who has tax expertise in a specific industry that your client demands.

- Maybe a remote staff with relevant software expertise in tax software interests you.

- Or you can choose a remote staff who has been trained under a tax reviewer for 5+ years.

Step 3: Conduct 1 on 1 interview

Once you are done handpicking your remote staff, you now get to interview them on a 1 on 1 call. This helps you dust off most of the doubts that you might have regarding hiring offshore tax preparers.

In this step, you can assess the remote staff’s skills by asking theoretical and practical questions. This will help you understand the level of the remote staff before you start working with him/her.

Step 4: Welcome the Tax Preparer on board

In this step, the remote tax preparer that you finalized will onboard and join your team within 24-48 hours. They will initiate the process of collecting the scanned documents via a secure remote access portal.

You don’t have to invest extra time in training the remote staff like how you would have to if you had hired an in-house tax preparer. This is because the remote staff has already been trained and has seen multiple tax seasons.

Must read Build Your Own Tax Team with Offshore Staffing Solutions

The Process Workflow at CapActix

We would like to tell you about our process workflow here at CapActix. The 3 main aspects of our process workflow are.

- Access

- Communication

- Task Monitoring

Access

We never ask you to share your client’s financial documents with us. To put it more clearly, your client’s financial documents will never leave your computer. We are an ISO & GDPR certified company, so we use advanced remote connection software that accesses your PC.

Here are a few different ways that the remote staff can access your PC via remote access.

Cloud – Using secure login access, the remote staff will log in to the software that you use and access the intended clients’ documents.

RDP Access – The remote staff will access the allotted computer via the remote desktop connection. Once the work is done, the remote staff will log out.

Must read Ultimate Guide to Outsourced Tax Preparation Services to India

Communication

The remote staff that will work with you will be fluent in English and will be able to understand and comprehend your instructions and questions. They are also techno-savvy in the different apps and software used for communication.

Immediate Response – We have invested in swift communication apps and software that allow file sharing, video conferencing, and much more. We make sure that the remote staff is online at all times to respond to your questions. You can communicate with the remote staff via Email, Skype, Slack, Microsoft Teams, SharePoint, or any other tool that you are comfortable with.

Time Zone Benefits – The remote staff will work in the Indian Time Zone, which works out as a benefit for you as you get 24 hrs turnaround time. In simpler words, when your in-house tax team stops working at the end of the day, your offshore staff will start working here.

Task-Monitoring

Regular review of work and task monitoring is very important. We understand its importance more than anyone else. So, we have built a transparent system, where you will be able to monitor the remote staff’s tasks by staying updated with the progress. That way you can identify issues and re-align the remote staff in the right direction.

Timesheet – You can know what the remote staff has done by reviewing his/her timesheet. The time sheet is prepared on a daily basis, which tells you how much time is spent on the given tasks.

Review Meeting – It’s very important to conduct regular review meetings. Based on the review meetings, you can assign further work, resolve queries and provide instructions for improvements.

Bonus Tips on Steps to Choose the Right Offshore Partner

It is a perfect solution for small and medium CPA firms to use outsourcing tax preparation services during the over-busy tax season. However, if you haven’t ever appointed an offshore team during tax season, then you must have gazillion questions surfing in your mind like how to hire a good team, where to find a trusted offshore team and much more. So, to answer all your bubbling questions, we have created a list of a few steps that will help you in acquiring the services of top-notch outsourcing tax preparation services for your firm.

Step 1: Check Referrals

Today, we live in a digital world where everything is powered by the internet. So, when you are planning to hire an offshore team from another hemisphere, then you can leverage the internet and check out online reviews of the company. The past experiences shared by other clients will give you a rough idea regarding – performance, consistency, and work quality.

Step 2: Familiarity with US Tax Rules

One of the next major things that you need to put in your offshore team hiring checklist would be – the familiarity of the offshore tax preparation company with the US tax laws. One of the biggest concerns of CPA & Accounting firms is whether tax outsourcing firms in India can understand tax legislation and policies or not. But outsourcing tax preparation services firms keep themselves updated with the legislation and policies.

Step 3: Go Through Basic Infrastructure

Once you have tested the knowledge of the company’s staff, then you need to make sure that the outsourced company has the basic infrastructure to pull off your project on time. An elite outsourcing tax preparation services company must have the following basic infrastructure:

- Hands-on training with all the latest and trendy tax preparation accounting software.

- High-quality security standards for both – internal and external. For internal security company must have CCTVs, security guards, etc., however, for external security – antivirus programs, encrypted systems, and SSL security needs to be incorporated.

- The company needs to provide all the latest gadgets and high-speed internet connection to their employees.

Frequently Asked Questions (FAQs)

Q1: What is the step-by-step process for outsourcing tax preparation services?

The step-by-step process for outsourcing tax preparation services typically includes:

- Research and select a reputable tax preparation service provider.

- Discuss your tax requirements, deadlines, and pricing with the provider.

- Provide the necessary financial and tax-related documents.

- Collaborate with the provider to address any queries or additional information needed.

- Review and approve the prepared tax return.

- The provider files the return on your behalf.

- Follow up with the provider regarding any updates or questions.

Q2: How long does it take to outsource tax preparation services?

The timeframe for outsourcing tax preparation services varies depending on factors such as the complexity of your tax situation and the workload of the service provider. Communicate your desired timeline with the provider to ensure they can accommodate your needs.

Q3: Can I communicate with the tax preparation service provider during the process?

Yes, communication is an essential part of the outsourcing process. Most providers offer various channels for communication, such as email, phone calls, video conferences, or secure client portals. You can address queries, provide additional information, or seek updates through these channels.

Q4: Can outsourcing tax preparation services help me minimize tax liabilities?

Yes, professional tax preparers often have extensive knowledge of tax laws and regulations. They can identify deductions, credits, and strategies to optimize your tax position, helping you minimize tax liabilities and potentially increase savings.

Q5: How can I track the progress of my outsourced tax preparation?

During the outsourcing process, you can maintain regular communication with the provider to stay updated on the progress. They may provide status updates, inform you of any issues, or address any questions or concerns you may have.

Conclusion

Tax preparation services are one of the most important services offered by a CPA firm as lots of legal compliances are related to it. So, it’s crucial to know the ins and outs of hiring offshore tax preparers before you go ahead. We have aimed to explain the entire process that we follow when you hire offshore tax preparers from CapActix.

Why CapActix?

Multiple CPAs and Accounting Firms have partnered with us for this Tax Season 2023, and others are in the process cycle of interviewing our remote accountants. A selected group of companies are outsourcing tax preparation services from CapActix at tailor-made packages.

If you have not made up your mind yet, don’t worry. Go ahead and try a risk-free trial for 2 tax returns.

Outsourcing Tax Preparation Services can be the boon that boosts your revenue. We recommend you hop on a call and get all your questions answered by our business head. Schedule a meeting now