Whether you are performing CPA tax preparation for your clients or your firm only, there’s a 99.9% chance that you have to deal with multiple tax glitches during the process.

Tax glitches come in numerous forms Sales Tax, IRS Tax, or State Tax troubles. You have to identify tax glitches before April rolls up because handling last-minute tax glitches isn’t a piece of cake.

CapActix being the leading tax preparation outsourcing company, has often dealt with tax glitches and has successfully overcome them. We consulted our outsourced tax preparation experts before the knock of Tax Season 2021 and asked them how to overcome tax glitches.

Expert Talk: How to Overcome Tax Glitches

To be honest, tax preparation is never void of glitches. No matter how much knowledge you have, anybody can make tax mistakes anytime. But, when you learn from your own experience, you can better manage your tax accounts.

Since our tax preparation outsourcing services have been serving for years, so we have some of the finest tips to overcome tax glitches:

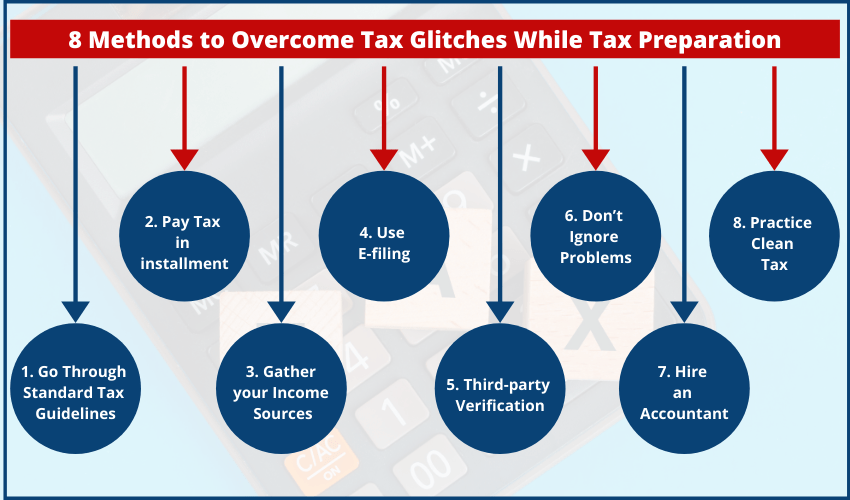

1. Go Through Standard Tax Guidelines

Before preparing your tax return statements, just go through the current financial year standard tax guidelines. You can simply go online and search for the prevailing tax slabs, interest rates, deductions, and other vital tax information.

2. Pay Tax in installment

To avoid CPA tax preparation glitches, don’t pay your entire taxable amount in one go. The IRS offers different tax payment methods that you can select to easily and correctly pay tax. When you pay tax through installment, you have less volume of financial information to process.

On the top, you can lessen the burden of paying lump sum tax money at once. With easy installments, you won’t even feel your tax burden.

3. Gather your Income Sources

You should gather up all your income sources before the tax season. Imagine, Mr. A is a lawyer, he works with a law firm, he also works independently, and he has a spare house that he rents out. So, Mr. A’s income sources are salary, freelance fee, and property rent, which should be aggregated together while calculating the net taxable amount.

Therefore, our experts suggest preparing a list of all the income sources and cross-check it before the tax preparation.

4. Use E-filing

To avoid common tax glitches, you should opt for the electronic tax filing method because it’s fast and error-free. You can easily calculate the tax amount online and pay with one click. When you have to handle multiple clients’ tax returns, online methods enable you to process multiple accounts in no time.

5. Third-party Verification

It is a human tendency that we can’t easily figure out our mistakes. Thus, if your one accountant has prepared a tax return, you should ask another accountant to cross-check it. Moreover, you can hire a third-party person to evaluate your tax returns.

You can avoid tax glitches using outsourced tax preparation services to verify and audit your tax reports. The outsourcing companies have a team of tax experts who can lend a hand to correctly compile your tax-related statements.

6. Don’t Ignore Problems

Usually, the IRS immediately notify the taxpayers when they find any tax problem. You might receive an email or letter from the tax authorities regarding the problem, and you should not take it lightly.

You should thoroughly study the problem and analyze why it has occurred. Next, you should prepare a response letter targeting the issue and take action to resolve it. It is recommended to reply back within 30 days.

If you make the mistake of ignoring the tax authorities’ warning, they can impose hefty penalties on you. Some tax-related offences are even categorized under criminal sections.

Therefore, when you receive a problem letter from the IRS, immediately contact your accountant or other tax professionals.

7. Hire an offshore Accountant

If you have been avoiding hiring a professional offshore accountant to reduce your operating expenses, you should hire one before tax preparation season. From auditing financial accounts to filing tax returns on time, you can’t manage all the tax stress on your own, period.

However, if you don’t have a sufficient budget to hire a professional offshore accountant, you can hire an outsourced tax preparation service provider for the tax season. You just have to pay a standard sum, and your tax preparation outsourcing partner will handle all the tax glitches for you.

8. Practice Clean Tax

The IRS is a public service department. It is developed to help the public—not to scare them. The department is very understanding; they understand that common tax glitches happen. So, they don’t press any hard charges when tax glitches occur due to omission of error.

But, when the same errors are often found in your tax reports, the IRS won’t take it lightly. They can press super serious charges against you that you might have to hire an attorney to represent your case.

Therefore, to avoid tax complications, you should always practice a clean tax. Never use shortcuts or illegal methods to save some money because once the IRS catches you, they can make you pay double money. Plus, when you maintain clean tax records, the number of errors will automatically reduce.

Here you can read about 6 Common Misconceptions About Outsourced Tax Preparation Services from India

Bottom Line

Tax glitches are unavoidable! But, when you practice the clean, organized, and knowledgeable CPA tax preparation, you can effortlessly avoid numerous glitches. The best tax preparation tip would be—always stay updated and focused while preparing tax reports. And start planning for tax season in advance.

Our team has served many tax seasons to date, so you can use their experience anytime by giving us a call or writing an email.