Tax preparation services are one of the vital components of an income for CPA firm. It doesn’t matter whether you are an individual or a company; you have to file a tax return—if you are making money.

Alone in 2017, 143.3 million tax returns were filed by taxpayers in the US, which is huge. However, when everyone has to file a tax return under the given period, it increases CPA firms‘ burden, and they start to look for tax preparation outsourcing services.

With outsourced tax preparation services, they can delegate some work to other offshore tax preparation companies to save their time and costs. Some companies even outsource work from India— where some of the highly qualified tax specialists provide services at moderate rates. The majority of accounting companies outsource from India because of the following reasons:

Price Lag – Indian currency rates are lower than in many countries, which gives them a perfect opportunity to hire qualified professionals at lower rates. For example, one US dollar is roughly equal to 70 Indian rupees (depending on current exchange rates. So, if a tax specialist in the US charges $140 per hour, it will be 70 times less in India.

Good Technical Support – India has good telecom, internet, and other technical infrastructure support, which makes outsourced tax preparation a smooth process.

Qualified Professionals – Indian tax and accounting curriculum is set as per international standards. So, Indian accountants are competent enough to work with international accounting standards.

The Indian outsourcing list could go on and on, but we can’t forget a part that some CPA tax preparation companies are still reluctant to offshore tax services from India. And in this post, we are going to burst all misconceptions related to outsourcing tax preparation services from India—so that everyone can take leverage from the cost-effective and proficient Indian tax specialist’s services.

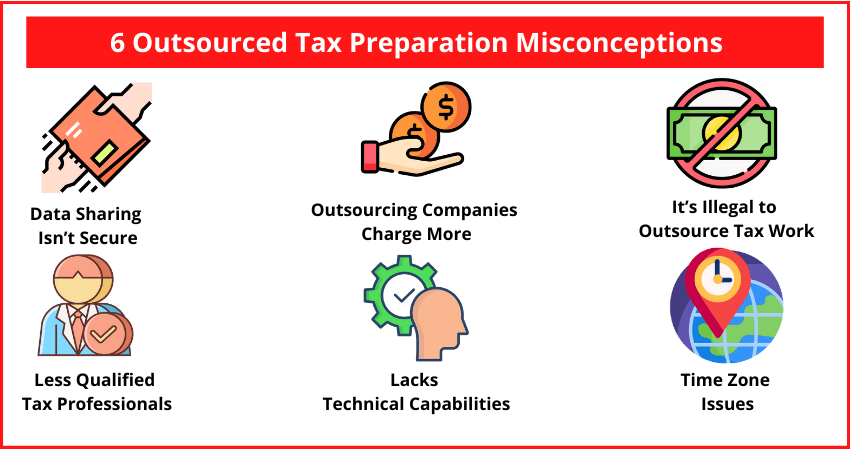

6 Outsourced Tax Preparation Misconceptions

The following myths concerning outsourcing tax work to India have been identified after researching the concerns of several CPA firms:

Misconception 1. Data Sharing Isn’t Secure

We can’t say that it is a wrong misconception because it is risky to share confidential tax information online. A data breach is always a risk. But, if your outsourced tax partner and you follow the secure data sharing modules, you can safely share information in between your servers.

For instance, at CapActix, we always suggest our clients to never use public servers like Gmail or Hotmail to share data with us. We advise them to use private cloud servers such as Dropbox, Box, etc. Importantly, we have also developed our own document management portal called “CapDoc”—which can only be accessed by trusted teams.

Therefore, your Indian tax partner can help you a lot when you share information through a secured portal.

Misconception 2. Outsourcing Companies Charge More

It is a complete myth because outsourced tax preparation companies only charge for what you have used. There’s no ambiguity or hidden charges presented—if you hire a professional company.

However, you can make this point clear by drawing a contract with your outsourced tax company so that you can clearly state all revenue terms and get them duly signed. Moreover, you simply have to pay an agreed amount to the company—no additional employee benefits or infrastructure costs.

Misconception 3. It’s Illegal to Outsource Tax Work

Many CPA firms believe that they might get in trouble with their clients by outsourcing tax preparation services. If you outsource tax preparation services without receiving your clients’ consent, it is ethically and legally wrong.

But, if you discuss with your clients that you might outsource tax services for betterment, you aren’t doing anything wrong. Usually, people trust their accountants like their doctors or lawyers, so if you tell your clients that outsourcing is in their best interest, they won’t hesitate to give their consent.

Moreover, under Rule 301, “Confidential Client Information,” AICPA covers the issue of using tax return preparation outsourcing services. So, there’s nothing illegal in outsourcing tax services.

Misconception 4. Less Qualified Tax Professionals

It is a myth that India doesn’t have many highly qualified and experienced tax experts. Some of the finest accounting and tax professionals residing in India have received training for the international accounting standards and US tax laws. On the contrary, you can find the best tax partners in India that can easily manage core tax issues.

If you take us for an example, our tax professionals can provide outsourcing tax preparation for —Form 1040, Form 1040NR, Form 1040A, Form 1040EZ, Form No. 1065, Form 1120, Form, 1120A, Form 1120S (for statutory corporations), Form 990, and Form 1041.

Here you can read about 8 Methods to Overcome Tax Glitches While Tax Preparation

Misconception 5. Lacks Technical Capabilities

CPAs, India is called an IT hub for a reason. India’s technical advancement is very amazing—from swift internet connectivity to the latest technologies—India has all. Similarly, Indian accounting firms are fully automated, and they use the latest accounting software.

Apart from the accounting software, they use powerful communication, team collaboration, and other software to provide flawless services. For instance, we use robust tax software to improve efficiency and accuracy levels, such as Intuit’s QuickBooks, Intuits Pro-Series, Intuit’s Lacerte, Drake, Turbo Tax, ATX, and many more.

Misconception 6. Time Zone Issues

Time zone difference isn’t actually an issue, but a blessing for CPA firms. If you are based on a different time zone than India, it will help you in providing 24*7 services to your clients, which is very useful during tax seasons.

Imagine, you are the US-based CPA tax preparation company, you can assign work to us in your evening, and by your morning, it will be done. This way, you will be able to deliver your services a lot more quickly and effectively.

Bottom Line

offshore tax preparation services can help you—save time, reduce cost, improve work quality, gain professional expertise, and so much more. Therefore, don’t let all the misconceptions cloud your judgment and clarify them soon to make a profitable business decision.

If you are interested in hiring CapActix to outsource tax preparation services, give us a call on – 201-778-0509 or email – biz@capactix.com.