Outsourcing audits, client bookkeeping, and accounting operations allow accounting companies to free up critical time to provide company advisory services, increase capacity, and expand service portfolios.

Internal auditing assures a corporation about the efficacy of organizational and managerial control in the business. The outsourcing audit function allows an independent third party to review an organization’s operations in accordance with international financial reporting standards. This assists a company in understanding weaknesses in their operations and receiving unbiased information on various hazards and degrading variables in the firm.

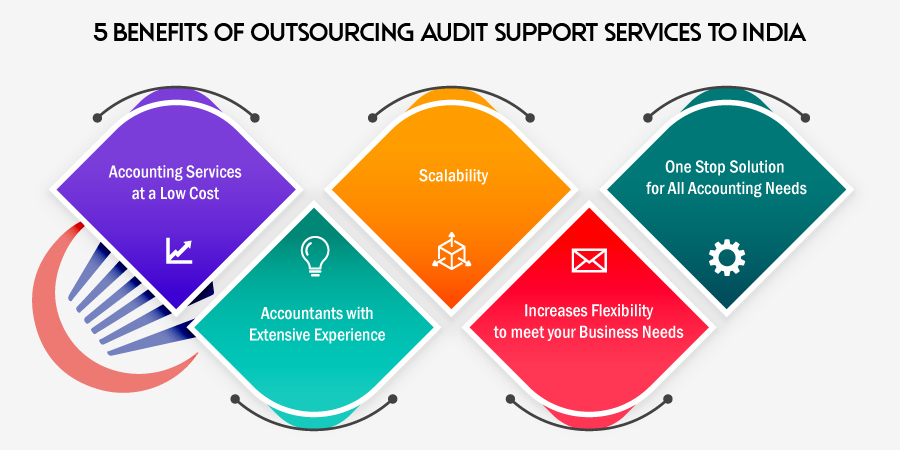

Accounting is one of the most widely outsourced functions by businesses of all sizes. Indeed, many business owners are learning that outsourcing provides a unique opportunity to obtain accounting support from experienced professionals while avoiding the additional expenditures associated with in-house workers. Here are the five advantages of outsourcing audit support services to India:

1. Accounting services at a low cost

In general, most organizations regard outsourcing as an additional expense and thus, unnecessary for their operations. It is not the correct perception at all. It is the inverse.

Some businesses may view auditing outsourced services solely through the lens of cost-cutting. This isn’t necessarily a bad thing. One of the most important advantages of outsourcing is cost-efficiency. However, from the standpoint of an accounting company, there are bigger questions to be answered than those regarding outsourced bookkeeping costs and ROI.

The savings that outsourcing normally generates can be quite substantial, as most businesses can offer their services at reduced cost rates (typically due to lower labor costs in India).

Furthermore, by outsourcing, you save money on salaries, taxes, office supplies, and benefits for full-time or part-time employees. You only pay for what you need. Even with a reduction in expenses associated with recruiting full-time personnel, there is no decrease in productivity.

2. Accountants and bookkeepers with extensive experience

Outsourcing may allow you to engage a professional with a greater degree of experience at a lower cost. To remain competitive in the market, outsourced audit and accounting service providers must constantly enhance their abilities and certifications. Consider the following scenario: 50 employees working in the same office. They can easily disseminate information about new accounting trends, solutions, and technologies. To add to that, top accounting firms have greater access to training and courses, where they can participate regularly to keep upgrading their skills.

Furthermore, outsourcing to an accounting firm provides you with access to a team of accountants for a fixed fee. Not just one individual to handle a variety of tasks.

3. Scalability (ability to scale up or down)

For newer firms, growing their business might be one of the biggest challenges they face. The capacity to scale up or down fast is one of the best advantages of outsourcing your accounting and finance services.

Businesses that have rapidly expanded, frequently experience issues with backend operations. This might stifle growth and cost the organization money.

There have been moments when the economy has been on an upswing, but there have also been instances when it has been in a slump. Examples include the 2008 recession and the influence of COVID-19.

In times like these, firms may try to lay off workers in an attempt to become more cost-effective with their money. But you don’t want good workers to quit since good personnel are still difficult and expensive to replace. Outsourcing accounting and finance allows you to scale up to accommodate a larger workload when the firm reaches a bottleneck.

4. Increases flexibility to meet your business needs

The fourth advantage of audit support services is increased organizational flexibility.

If your team comprises merely two or three persons, you must keep them engaged at all times. However, if they have too much workload and not enough time, it might be an issue. They lack the adaptability to take on new responsibilities as your company develops and matures. It can be aggravating, and you have to wait.

For example, recently, PPP was a requirement that elevated accounting teams’ duties to levels that they could not handle. Many people have to seek outside assistance to complete this task.

5. One Stop Solution for all your accounting needs

The key to your company reaping all of the benefits of outsourcing bookkeeping is to work with the proper supplier. Aside from professional bookkeeping competence, experience, and a low-cost engagement model, outsourcing from a successful audit support services provider can help your business thrive via:

- High-performance metrics: Successful outsourcing bookkeeping service providers in India meet strict accuracy requirements. Generally, you don’t want to go over the bookkeeping service with the client before handing it to them. As a result, make sure your service adheres to the highest quality standards. An ISO 9001 quality certification is one such standard that you might seek.

- The turnaround time: One of the primary reasons you will want to outsource is to provide services to your clients more quickly. As a result, working with a provider who can complete bookkeeping services fast while maintaining quality is an excellent option.

It is essential that your transition to outsourced bookkeeping and auditing services be well-planned and supported by thorough research so that you can overcome any potential internal obstacles easily. To get started with reliable outsourcing audit support services, Visit our website for more details regarding our firm. Contact us at +1 201-778-0509 or reach out at biz@capactix.com.